We know that GaN and SiC are a recurring topic, and you may be overwhelmed with it. We are sorry but what has been said about Gallium Nitride (GaN) and Silicon Carbide (SiC) power devices’ market in the past hasn’t done much good to the Power Electronics community. At PntPower.com, we want to be talk openly about what is happening. So here is our point of view.

The question is: “Who really needs GaN or SiC Power Devices?”

We’re not the kind of analyst to go through the usual message about WBG and how they are awesome and will change the world. Yes, the technology is interesting. But we strongly believe it’s not about the performances, it’s about the product/market fit. So the only question we need to ask ourselves is: What do GaN and SiC bring to power electronics systems, that IGBT, MOSFET and Super Junction MOSFET don’t?

We worked on applications-oriented market reports in order to start answering this tricky question. The idea was to define the market segments where GaN brings a real competitive advantage (not only performance-based, any competitive advantage). What we learned was: many market segments will be open to GaN penetration only when prices drop. GaN devices manufacturers may say otherwise to try and sell a wonderful world with GaN everywhere, but many applications are too cost-driven to ever be interested.

It’s quite the same story for Silicon Carbide. The technology has been here for a while, but it took time for the right product to find the right market. And that fit happened on a much higher voltage than the current product offering. So potential users had to be patient. The market estimations produced in the early days of SiC looked very optimistic for a while, now they are more reliable (only a few years later).

GaN Power Devices and SiC Power Devices’ market penetration cannot be compared

We know you had many market reports trying to tell you about this marvellous competition between the two Wide Band Gap materials, GaN and SiC. But why would GaN and SiC be in competition on the Power devices market when one gives its best at 10 kV (or so) and the other at 0.6kV (600V)? These power devices simply do not compare, and so don’t their market penetration. We cannot measure different technologies on a similar scale when they bring different advantages.

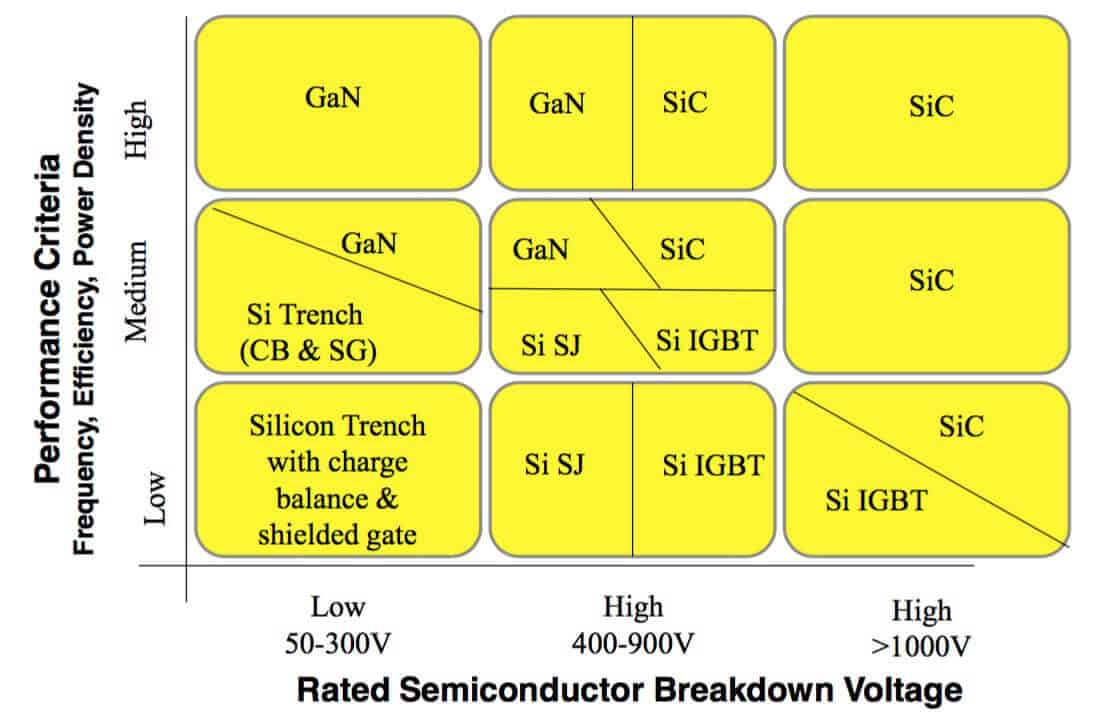

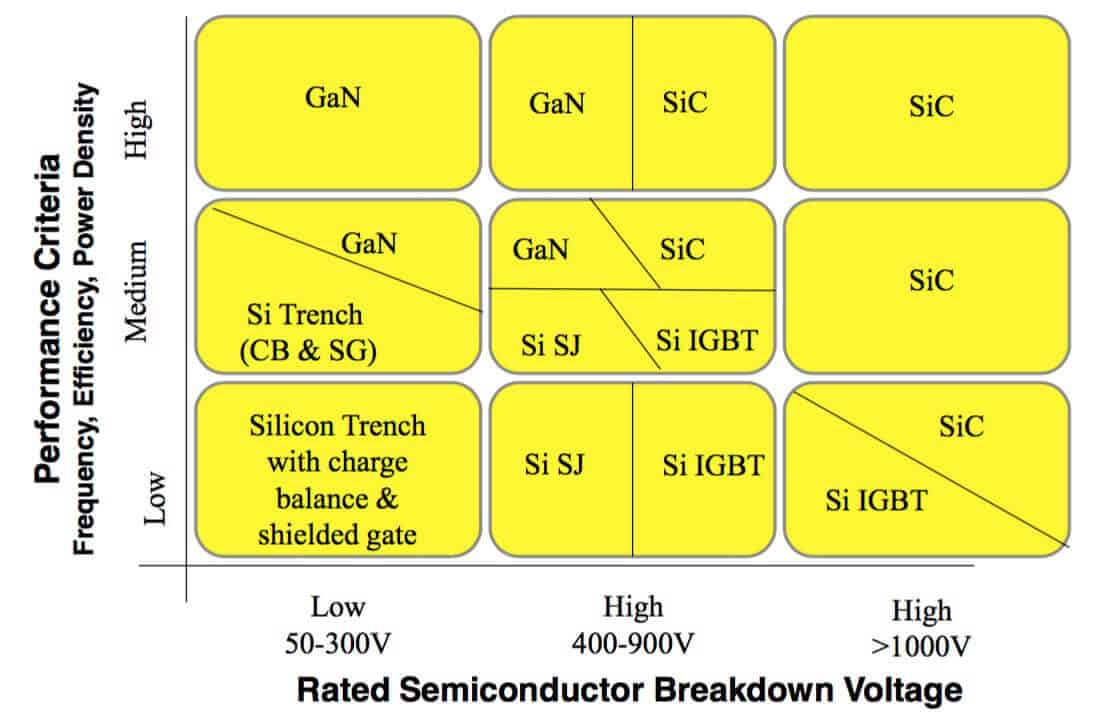

Extract from a Fairchild Semiconductor presentation. Designed originally by Alex AVRON, founder of PntPower.com

GaN is fit for lower voltages, high-end products. It is in direct competition with Super Junction MOSFET, when SiC is in competition with IGBT. The only voltage range SiC and GaN share could be 600V in the kilowatt range applications. But in this voltage range, we believe that GaN will quickly be cheaper than SiC, and there will be no competition. So there’s no huge fight coming up: we’re pretty sure that only one technology perfectly fits your needs.

There is a possibility that GaN reaches good performances up until 1200V later, so that’s something that could move the lines a bit in the future. But we’ll see…

Now what do the end-users and system designers feel about SiC and GaN: enthusiasts? In the end, they’re the only ones who will validate the product/market fit. The replies we had from the people we interviewed were very different from one application to another and the whole analysis is synthesized in our market report.

Teaser: the main idea is that the first market segment to adopt GaN will be the consumer applications segment.

GaN Power Devices is for Consumer markets first, and SiC will be for Transportation markets

Wide Band Gap power devices are not cheap, so the benefit of using them rather than another (cheaper) technology has to be huge. What would be that benefit, and could it be important enough to make the cost a secundary criteria? Years ago, Super Junction MOSFETs brought smaller and more efficient power supplies to consumer applications. This tendency to value size and efficiency for a device has not slowed a bit, it has even become a huge deal in the consumer market. A deal worth value, thus a deal that makes GaN interesting, despite its higher cost. Innovation is driven by high-end side.

Many have been struggling to define what the future application for Silicon Carbide MOSFET will be. The SiC material characteristics provide devices with a very high-blocking voltage (much higher than GaN, MOSFET and even IGBT). This characteristic makes it very attractive only for a limited type of application. These applications, such as rail traction or Grid and T&D, are already working on R&D development for these devices. But these segments also have very long product lifecycles (35 years for rail traction!), which makes production introduction and adoption very long.

When one technology leads to the consumer market, and the other one to complex industrial markets, we can bet that market penetration and trends will not be very similar.

The Next Steps for SiC & GaN in Power Electronics

Don’t expect Wide Band Gap to be quickly adopted in the power electronics world. Those things take time. For human reasons, for technology reasons, for money reasons. But if you want to know better what will happen for GaN in power electronics, we have a market report for that.

Curious about the SiC market? We plan on releasing an online training in 2018. Meanwhile, you can write us a message with your questions and we will give you an answer.

Infineon acquired a ready for production GaN technology together with it’s

Infineon acquired a ready for production GaN technology together with it’s