– Tesla Model 3 production is ramping up, together with the production of Silicon Carbide MOSFETs used in its inverter.

– We investigated ST Microelectronics production capacity and compared it to Tesla’s production objectives.

– It look likes a shortage is slowly growing in the SiC MOSFET market, and it’s here to last.

To follow the EV market, follow Tesla

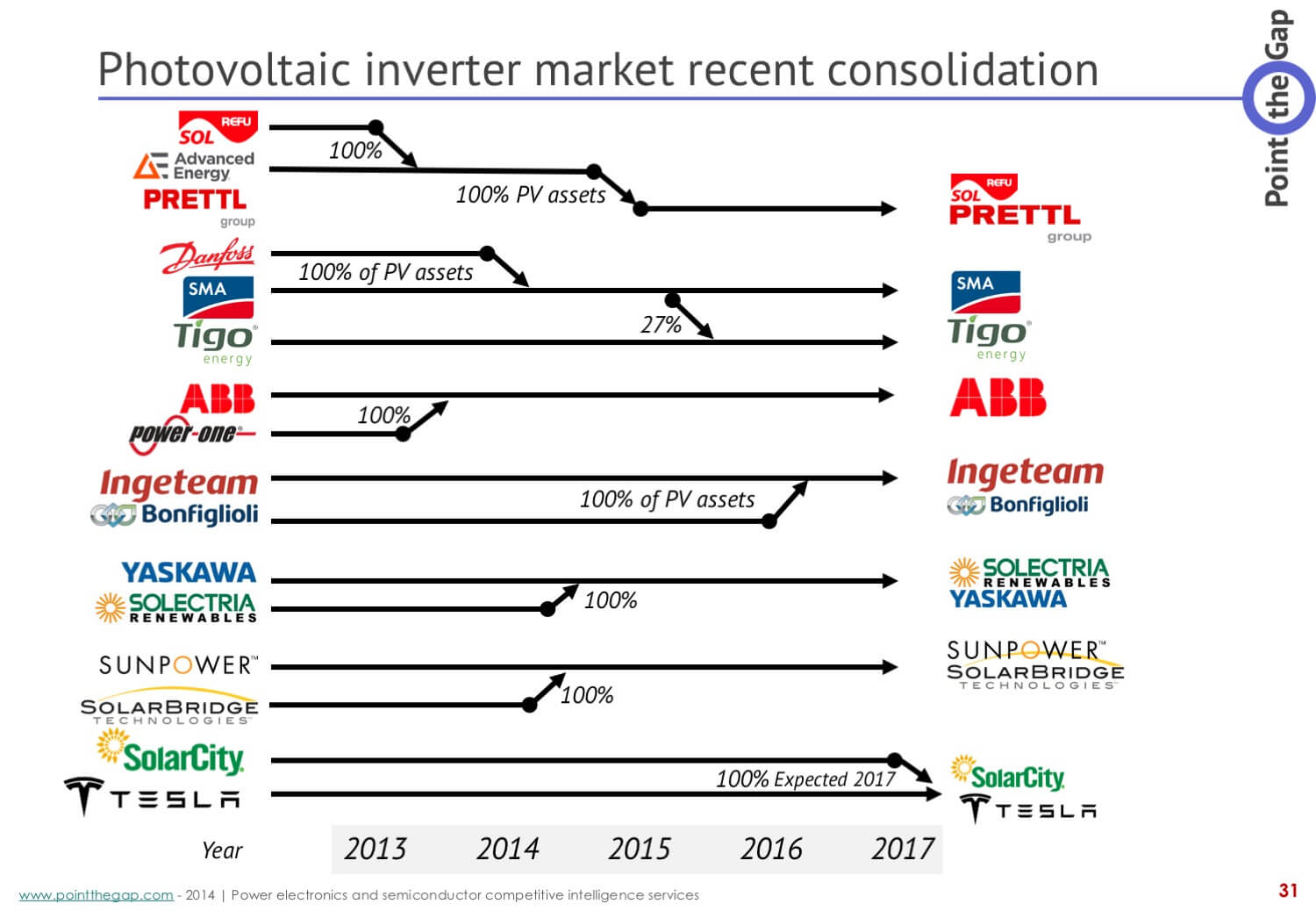

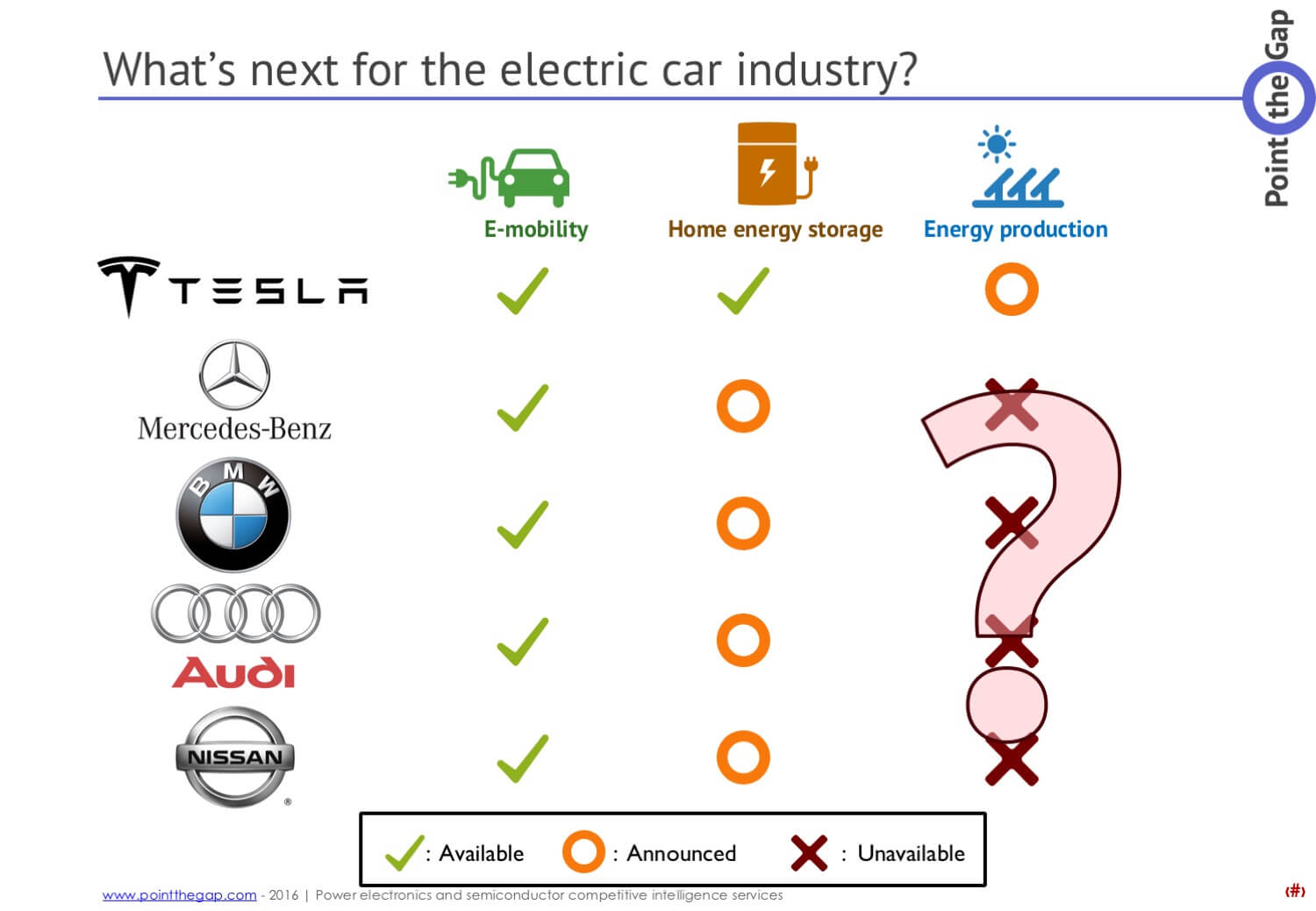

Tesla has been a subject on this website and in the Power Electronics community since the first release of the Roadster and the Model S. The interest is growing as it seems the company is holding a large part of the Electric Vehicle market. They drive innovation and participate, if not define the trends. Tracking Tesla’s technology choices is tracking a big part of Electric Vehicle market technology.

The Model S was a first and very interesting Electric Vehicle. We already pointed out the special strategy of Tesla, that highly participated in the company’s success. They are not making Electric Cars for ecologic reasons, but rather make EV because it gives awesome performances to a car. They just happened to be an alternative to fossil fuel. Model S is a great example. With an almost 600 hp and a 0 to 100 km/h in 4,4 s for the “slowest” model, down to 2,4 s for the best one, It accelerates faster than Lamborghinis (yes, all of them!). But still, the Tesla Model S has 5 more seats than Lamborghinis…

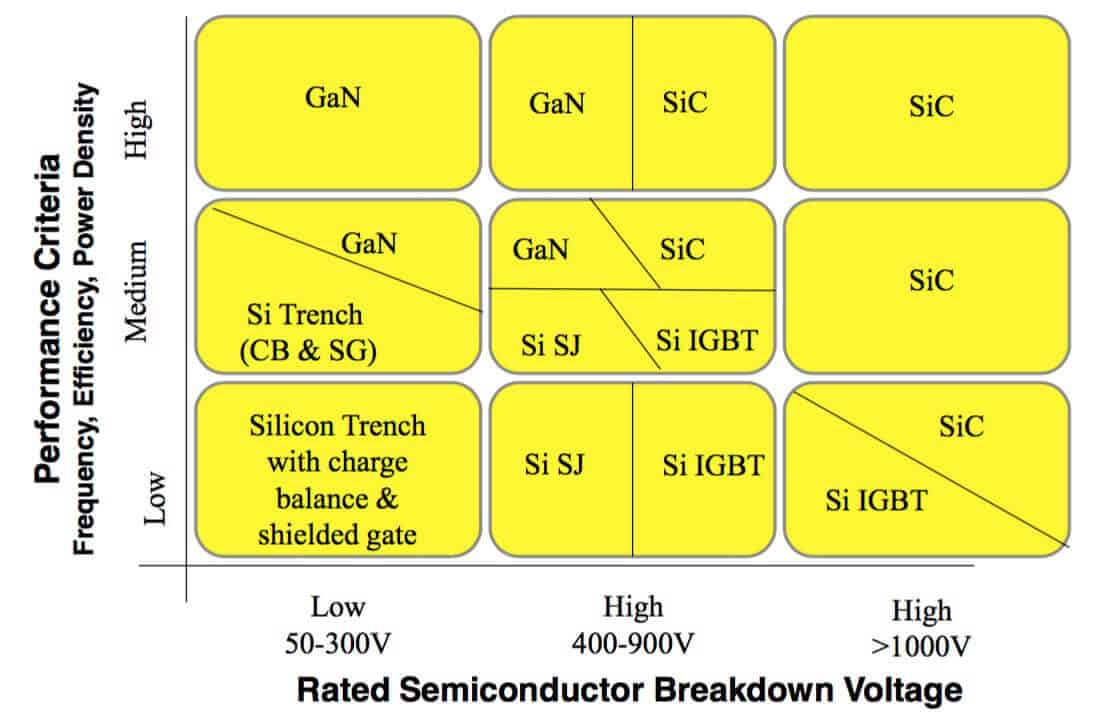

The Leap: From Si IGBT Discrete to SiC MOSFET Custom Module

This first mass produced EV from Tesla has been well analyzed on our side: It uses discrete IGBTs, produced by Infineon, and we wrote a long article on the technology choices. They are using discrete components to drive the motor with a car that requires up to 1500 Amps peak. Then came Model X, the luxury SUV from Tesla. It used similar components and topologies compared to Model S, at least on the power conversion side. Tesla’s management decided to stick to what was working. It was probably a safe move to release quickly a second mass market car, and be sure to reduce production issues.

Model 3, on the other side, is expected to be the first accessible EV car with long range. It has been presented as the first “ICE” killer car (ICE: Internal Combustion Engine). For the later, Tesla’s technical team went for a completely new design. Our analysis article detailed very well the power modules, and components used (SiC MOSFET from ST Microelectronics). Tesla is already ramping up production, with more or less success. We believe they had to put some innovations on the table, and bet on the production price to drop with volume. That’s what drove them into custom made power modules with Silicon Carbide MOSFETs. No one, in the EV market, took the risk to integrate SiC at motor drive level, before Tesla and its Model 3.

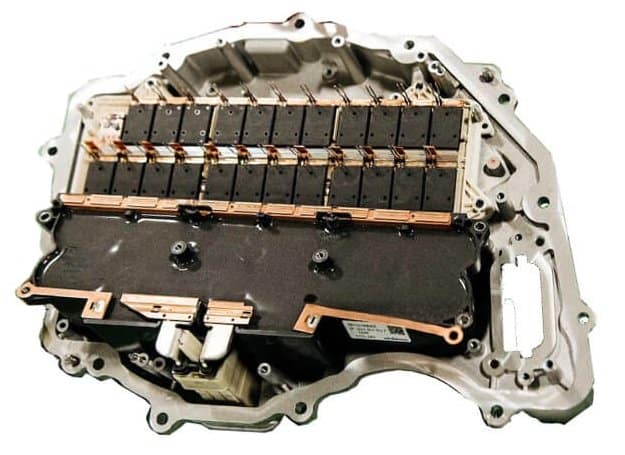

Similar to ST Microelectronics SiC modules for Tesla Model 3

Source: Boschmann

Investors, early buyers, competitors, suppliers and market analysts are all watching closely the Model 3 production numbers every week. PntPower is no exception to this rule. We have made our homework of analyzing Tesla’s production numbers. But one thing stroke us: How can the SiC MOSFET production follow Tesla’s needs? They reached their target of 5,000 cars produced every week by Q4-2018, each using 24 modules of 2 SiC MOSFETs. We had to compare it to ST Microelectronics production capacity.

Tesla is eating all ST Microelectronics SiC MOSFET production capacity

Following Tesla’s production is actually easy, as many investors watch closely any moves from the manufacturer (together with the SEC…). Bloomberg has a full page, auto-updated, dedicated to Tesla model 3 production status. According to that page, Model 3 is currently produced at a peak rate of about 4,500 units/week (as of Q4 2018).

A Model 3 has one main inverter that requires 24 power modules, each of which based on two Silicon Carbide MOSFET dies. These MOSFETs are made by ST Microelectronics fab in Catania, Italy, but we will come back to it later. It is a total of 48 SiC MOSFET dies in each car.

This means Tesla need 3 Million SiC MOSFET dies every quarter to keep its production rate of Model 3, as of early January.

Now, ST Microelectronics is producing 650V/100A Silicon Carbide MOSFET from it’s fab in Catania, Italy. We took the hypothesis of a 4 mm x 4 mm die size. This matches a current density of 6.25 A/mm². They are produced on 6 inches wafers (150 mm), which is a recent fab improvement from ST Microelectronics. We believe this improvement date matches the production start for the Gen. 2 SiC MOSFET that equip Tesla electric cars. Thanks to a marvelous tool (Die Per Wafer Calculator) that every semiconductor market analyst knows very well, we can estimate the number of dies per wafer at 702. These dies are not all good, as nobody has a 100% yield, especially in manufacturing SiC MOSFET. We have to insert a bit of hypothesis here. Let say that 75% of these dies are good dies. This is already quite an optimistic figure. We based our estimation on the production capacity of ST Micro Catania: 30,000 wafers/week, including 6 in. and 8 in. production lines. The SiC line is on 6 in. wafers only. According to our sources, it’s 800 wafers/week until Q3-2018 and will ramp-up at 1000 wafers/week by Q4-2018. We estimate that 85% of this production was dedicated to Tesla in Q2 2016, in order to stock MOSFETs for Elon Musks optimistic production ramp-up back then. We known ST Microelectronics has to make some devices for other customers time to time…

Based on these numbers:

- ST Microelectronics produced 3,420,000 SiC MOSFET modules thanks to their ramp-up

- Tesla Model 3 production consumed 2,950,000 SiC MOSFET modules

We can easily see that, without a stock of power modules, Tesla would be quite a tight supply-chain. But mostly, Tesla’s ramp-up relies mainly on ST Microelectronics’ ramp-up, and Catania fab better be efficient, and quickly, in order to extend the reach of ST Microelectronics to other potential automotive customers

We expect ST Microelectronics and Tesla to have signed a contract during the first Model 3 design phases. They most certainly started stocking dies from the first day they knew they would need it. A main objective for them must have been to secure as much as possible. This buffer stock became their comfort mattress for any slow down in production or breach in the supply-chain. We also expect Tesla to rely partially on a second source (with a contract that might be less advantageous) to ramp-up production. This second source appears to be Infineon. But these are assumptions and even if Infineon say they are second source, we still find it difficult to integrate a different SiC MOSFET die, knowing the technology is new. A different supplier would mean driving and design tweaks.

Tesla drives the SiC MOSFET market

Summarizing all this, we do not see how Tesla’s current need for SiC MOSFET does not affect the market. There is no other way than a growing tension in supplying SiC MOSFETs to customers, and we expect it to benefit to every manufacturer in the field. Customers unable to get a SiC MOSFET from ST Microelectronics or Infineon will go to their second or third choice. It will help everyone fill their lines, and invest in larger capacity. Don’t be surprise if SiC MOSFET manufacturers smiles look more authentic than before: The power is on their side now (so to speak…).

Don’t be surprise if SiC MOSFET manufacturers smiles look more authentic than before: The power is on their side now (so to speak…).

Searching for clues

The market analysis consulting job is not only about throwing forecast about sun, rain and wind, based on assumptions from looking at the sky… We also need to evaluate the confidence we have in our estimations or hypothesis. Here we used large estimations of yield and needs, to thicken the confidence in the conclusion.

But there are other signs or clues we can follow here. A first one, is to go to a distributor website (Mouser.com, Digikey.com, Arrow.com, FutureElectronics.com). You can check for yourself, and see what is the status. At the date of publication, only one SiC MOSFET from ST Microelectronics was listed as available: 1200V/12A SCT10N120. It’s a Generation MOSFET among the first MOSFETs to be produced. We believe these stocks dates from before the Tesla-ST Microelectronics deal.

It could be a Photoshop picture of a MOSFET :

It could be a Photoshop picture of a MOSFET : We built a course

We built a course