X-FAB Silicon Foundries has announced it will expand the capacity and capabilities of its Kuching-based foundry operation, X-FAB Sarawak Sdn. Bhd., to meet accelerating demand for its core technologies – the 0.18µm and 0.35µm process platforms. With revenue having grown 25 percent for each of the past two years, and similar growth expected for the next two years, X-FAB plans to invest a total of US-Dollar 114 million between 2015 and 2017. This includes capex spending amounting to US-Dollar 29 million in the current year.

X-FAB Group with its clear focus on automotive, industrial and medical applications has transitioned X-FAB Sarawak from a manufacturing facility for commodity-type products into a high-value-add business for products with a long life cycle. Since it became part of the X-FAB Group in 2006, the site in Kuching has undergone a complete change in most of its technology portfolio, its application focus, its customer base, product life cycles and quality systems.

YB. Dato’ Sri Mustapa Mohamed, Minister of International Trade and Industry said, ”We are very excited that X-FAB Sarawak, one of the two pure-play semiconductor wafer foundries in Malaysia, continues to be at the forefront of our local semiconductor manufacturing industry. The decision made by X-FAB to expand its operation in Malaysia is testament to the country’s strong economic fundamentals and the capabilities of our local talent.”

“X-FAB’s operation in Sarawak has been driving the growth of local economy. They are employing more than 1,000 staff where more than 80 percent of them are considered to be high income earners. We believe that this expansion will act as a catalyst in attracting other high technology firms to establish their operations in Malaysia as they will be able to leverage on the wafer fabrication services provided by X-FAB,” he added.

“The State of Sarawak as a major shareholder is very satisfied with the recent development of both the X-FAB Group and, more specifically, the profitable growth of X-FAB Sarawak, said Dato’ Seri Tarmizi Hj. Sulaiman, Chairman of the Board of X-FAB Silicon Foundries SE. “We are pleased that X-FAB Sarawak developed from a small nucleus into a competitive industrial enterprise with the competence and help of X-FAB.”

Rudi De Winter, CEO of X-FAB Group said, “We are looking back at nine years of successful conversion and expansion of our Sarawak foundry operation. During this period, we changed the digital business into a more future-oriented business with our complex analog/mixed-signal technologies. These technologies primarily used for automotive, industrial and medical applications enabled us to build a stable and sustainable customer base. In 2016, we expect X-FAB Sarawak for the first time to represent more than 50 percent of X-FAB Group’s total revenue.”

Mike Young, CEO of X-FAB Sarawak, added, “I am very impressed by the site’s evolution over the past several years and the success we accomplished thanks to the dedication and commitment of all our employees here at X-FAB Sarawak. Our continuous efforts to excel have paid off, as confirmed by the two awards we received in 2015 for our outstanding HR achievements, namely “The Prime Minister’s Award for Excellence in Human Resources” and “The 1Malaysia Employer Award for Big Companies.”

Source

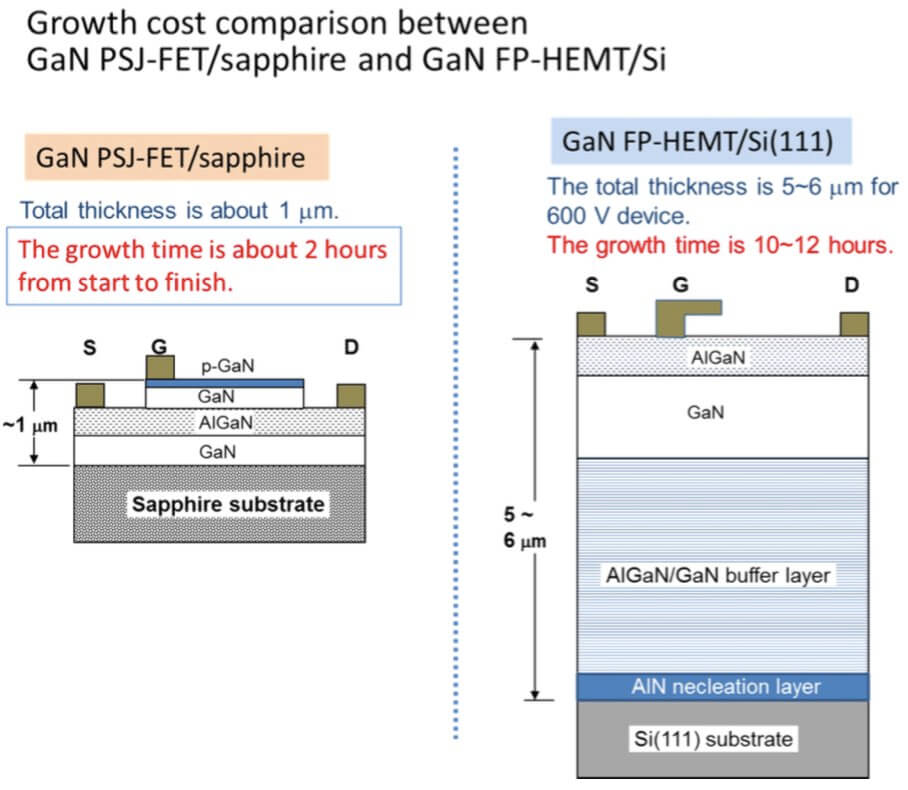

Sapphire substrate is also a common platform for GaN-LED production and the growth runs successively without chamber-cleaning. On the other hand, the growth on Si substrate needs chamber-cleaning prior to the deposition to avoid the unwanted chemical reactions between GaN and Si interface. The chamber-cleaning takes extra time and cost. As a whole, the throughput for GaN PSJ-FET/sapphire growth is roughly ten times larger than that of the GaN FP-HEMT/Si growth.

Sapphire substrate is also a common platform for GaN-LED production and the growth runs successively without chamber-cleaning. On the other hand, the growth on Si substrate needs chamber-cleaning prior to the deposition to avoid the unwanted chemical reactions between GaN and Si interface. The chamber-cleaning takes extra time and cost. As a whole, the throughput for GaN PSJ-FET/sapphire growth is roughly ten times larger than that of the GaN FP-HEMT/Si growth.